Formulating a business idea in your mind is the first step in starting a business. However, this can remain an idea forever if you don’t initiate the required steps to realize your concept.

Also, how well you execute these steps determines if you start a successful business or not.

Starting a business, whether big or small, takes work. It demands a lot of thinking, research, and planning.

Depending on the type of business you want to start, it may also require funds.

However, this should help you reach your goal of starting a business. Yes, it will be challenging, but with the proper guidance, it can be straightforward.

But where do you start? If you want to learn how to start a business, follow these 15 steps to launch your company.

Table of Contents

Identifying the Right Business Opportunity

You can only start a business by identifying what you want to do. As such, the first step is formulating that idea in your head.

Several factors influence finding the right opportunity, including your expertise, funds, and time.

You need to decide if you are targeting to start a low-budget business or whether you have enough funds for any business. Also, are you looking for a side hustle or a full-time business opportunity?

Your interests will also play a significant role when choosing the best business idea for you. Therefore, take time to understand what you love and are experienced in.

Research is a great way to find opportunities. It helps you see gaps in the current market. You have a business idea if you can find a solution to bridge those gaps.

Validating the Business Idea

Before proceeding, ensure that the business idea can generate income. The ultimate goal of any business is income.

Validating your idea means researching your product and the audience. You need to identify the gaps in the market and see if your product or service can bridge them. You also need to identify your target audience. Knowing whom you want to serve and the problems they are facing makes it easy to come up with the best product or service.

You can define your audience based on their age, gender, location, shopping behaviors, social media platforms they visit, and needs. This helps you determine the type of product to offer and the marketing strategies to use.

Thorough market research about your audience determines whether you are on the right track. You can gather your data through surveys, interviews, or focus groups.

It would help to research your competition and identify and study your audience and products. This stage enables you to understand who your competitors are, what they are doing right, and what they are missing. It allows you to define your USP (unique selling proposition), which sets you apart from the rest of the businesses.

By understanding your competition, you’ll always be ahead and make data-driven decisions.

Formulate a Business Plan

Starting a business without a plan is a remedy for failure. And since no one wants to start a company doomed to fail, take your time and create that business plan.

A business plan guides you in almost every aspect of your business, from describing your type of business to how it will operate, the kind of audience, how much it costs, where to find funds, and even the anticipated results. It will also include the type of products or services you are offering and how you intend to achieve your goals.

If you are searching for funds to start a business, you present a business plan to potential investors. Therefore, it should be detailed but precise to make it easy to understand. Also, including accurate financial projections and budgets will help investors see how you intend to use their money.

Lastly, remember to include explanations of how you intend to handle challenges that spring along the way. If you can’t offer a realistic course of action, the investors won’t trust your ability to deliver. Also, even when using your own money, this might present challenges that threaten the success of your business.

In essence, your business plan should include:

- Company description

- Market analysis

- Organization and structure

- Mission and goals

- Products and services

- Market plan

- Financial plan

- Background summary

- Executive summary

Note: While the executive summary is the last thing you write when creating a business plan, it appears first on the business plan.

Pick a Business Structure

The next step is deciding the business structure you want to adopt. Do you want to start a sole proprietorship, a limited liability company, a partnership, or a corporation?

Each of these business structures has unique benefits and drawbacks. You must choose one that best suits your business idea, needs, and future goals.

For example, the business and the owner are considered one for tax purposes in a sole proprietorship. The entrepreneur is responsible for unpaid debts or expenses if the company fails.

On the other hand, an LLC (limited liability company) separates business issues from those of the owner/s. The owners are not responsible for debts or unpaid expenses when the business fails. Business assets are used to clear any outstanding debts and liabilities.

Partnerships can be limited or general. In general partnerships, the partners and the business are one, just like in the sole proprietorship business structure. The partners inherit the business’s responsibilities in case of financial or legal issues.

However, limited partnerships act just like LLCs. The partners’ liability for business activities is only to the extent of their investment.

The IRS considers all these business structures to be different. They have other tax obligations that you must consider before making your decision.

Start A Business: Register Your Business

Now that you have done enough market research and know what business structure to adopt, it’s time to register that business.

Registering a business requires several steps and legal issues. Follow these steps to register your business:

- Choosing your business name: The name should be unique, memorable, and not registered by any other business. Check the USPTO website for trade name infringement.

- Register the business: Fill out and file the necessary forms for registration with your state. This is usually done at the Secretary of State’s office. You’ll also need to appoint a registered agent to receive legal documents for your business.

- Apply for EIN: It is an employer identification number that every business should have, except sole proprietorships without employees. Apply through the IRS website.

The state will notify you when the registration is approved.

Get Licenses and Permits

Even after registration, you still need more documents before starting your business. These include licenses and permits.

The necessary licenses are determined by the type of business and the state you are in.

Since different states have different regulations, research what you must comply with first. You can check the licensing information from the local government office or an attorney.

Having the proper licenses and permits allows you to start your operations. Therefore, ensure that you have what is required.

Open a Bank Account

A business bank account is essential. It helps to separate your finances from that of your business. This step should be noticed even if you are opening a sole proprietorship.

With a business bank account, you can quickly pay for business expenses and taxes without worrying about mixing it with your costs. And the good thing is that account opening can be done online for most US banks.

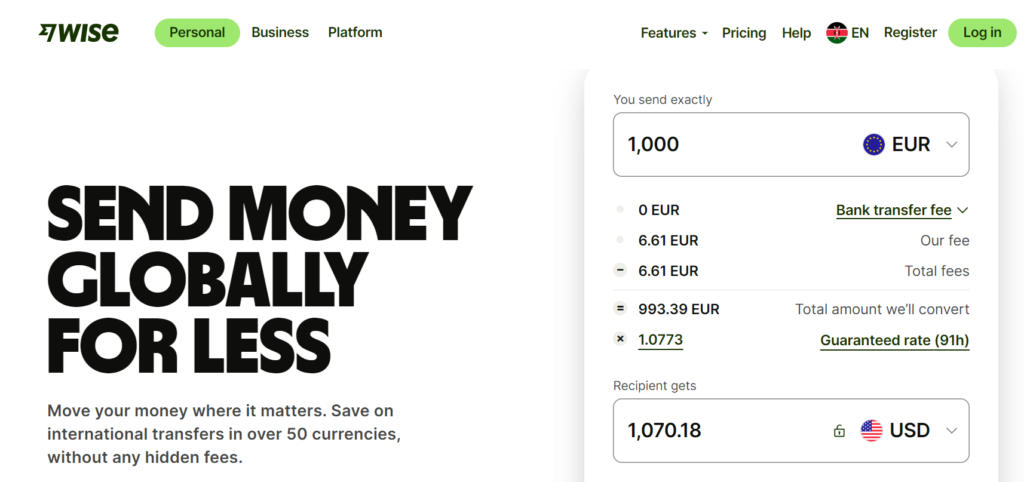

You can open a virtual US bank account using Wise.

Understand Your Financing Options

When starting a business, you certainly have some capital saved somewhere. And if you don’t, you must know where to get the money.

Generally, new businesses need capital to start and operate before making money. However, acquiring funding for a startup takes work.

This is because the company needs the necessary credit history that lenders require.

Some of the main funding options for new businesses include:

- Your savings

- Credit card

- Loans from family and friends

If these aren’t sufficient, you can try external sources such as:

- Crowdfunding

- Small business loans

- Venture capital

- Small business grants

- Angel investors

However, when considering these options, evaluate their terms and conditions. For example, what are the interests? What is the repayment timeline? And how much money does your business need?

This way, you don’t take a loan or type of funding that becomes detrimental to your business.

Build a Business Website

According to recent studies, around 28% of businesses conduct business online, and many customers are found online. Thus, having a website is an excellent thing to consider.

A website helps you cater to the needs of your online audience, even if you have a brick-and-mortar location. A functional website is necessary if you run your entire business online.

However, consider cost, features, and ease of use when designing a website. Build a website that gives customers the best shopping experience.

You can set up your e-commerce business on your website or use e-commerce store builders. These include Shopify, Wix, WooCommerce, BigCommerce, etc. Compare the platforms to determine which one offers value for your money.

Consider the cost, features, integrations, and more to choose the best e-commerce platform.

Apply for a Business Credit Card

Credit cards can help you build your credit history for future funding. Also, they can be a short-term financial solution for your financial needs. So, ensure you have that credit card before the business goes far. Most business credit cards offer numerous benefits, such as travel perks and discounts.

However, ensure that you use the credit card wisely. For instance, only use it when necessary and within your spending limits. It is also paramount to pay your debt every month.

Late payments can get you into a debt cycle that ruins your current and future finances.

So, even as you enjoy the convenience of using that credit card limit, know the consequences of not adhering to the terms and conditions.

Get a Business Insurance Cover

No matter what kind of business you’re starting, an insurance policy is crucial. It protects your business and your workers against any risk that might occur.

Generally, the ideal policy for your business depends on the type of business. The risks present also play a significant role in the kind of policy you get. And if you have employees, worker’s compensation insurance is a must-have in most states.

If you need to know the exact type of insurance that best suits your business, you can work with an agent. They will assess it and recommend the best policy.

Some of the primary insurance policies for businesses include:

- Workers compensation insurance

- Property insurance

- Liability insurance

- Product liability insurance

- Business interruption insurance

- Employee practice liability cover

Acquire the right insurance coverage to ensure your safety, business, and employees.

Acquire the Right Tools

If you want to increase productivity in your business, it’s essential to integrate the right tools. Business tools not only make your business processes easy, but they also bring about efficiency, saving time and resources.

With the right tools, you can automate almost every aspect of your business, leading to satisfied customers and less workload for your staff. Some of the tools you can consider for your business include:

- Accounting software

- CRM (customer relationship management)

- Credit card processor

- Project management tool

- Point of Sale

If you are into e-commerce, consider a platform like EcommerceBot. Its features include order and inventory tracking, social media management, an omnichannel chatbot, and AI ads automation.

Such features automate numerous business processes, making handling customers and leaving them satisfied easier.

Get Your Taxes in Order

As a business, you’ll have to pay your tax obligations once you start operations. Therefore, prepare as early as possible.

It would help to learn what is required to avoid the last-minute rush. If there are any tax breaks or credits, you also need to take advantage of them.

In most cases, new business owners must be better versed in taxes and requirements. If that’s you, start nurturing good relationships with tax professionals. They will be helpful later, especially if you need an in-house tax professional.

Market Your Business

Effective marketing is required for your business to succeed. People need to know about your business, products, or services.

Marketing includes finding the best message to convey to your target audience to help create awareness and encourage them to try your products or services.

The process is complicated and requires you to understand your target audience, know where to find them and determine what would appeal to them. From here, you can create content that best represents your brand in the eyes of your audience.

There are several ways you can market your brand. These include:

- Developing a social media strategy

- Optimizing your website for SEO

- Using paid ads

- Listings on online directories

Note: Create relevant content that resonates with the target audience. Otherwise, you might spend a lot of resources and achieve minimal results.

Scale Your Business

While you might start small, everyone wants to see their business grow. This is something you should start planning for as early as possible. And when the right time comes, scale your business to new heights.

Scaling your business involves growing your revenue and customer base.

You can do this by increasing your marketing activities, improving customer engagement and support, ensuring efficient order fulfillment, offering new products, etc.

But to be able to do all this, you must grow your team, automate various processes, and even outsource some services.

For example, outsourcing order fulfillment relieves some of the burden and gives you more time to focus on other essential business issues.

Automating some processes is also a great move. For instance, you can integrate EcommerceBot into your business to automate ad creation and placement.

The platform also helps you automate social media management, including creating and posting relevant posts.

And if you want to improve your customer relations, it comes with an omnichannel chatbot for fast and accurate responses to customer queries.

You can try Ecommercebot for free; no credit card is required. You agree to turn your E-commerce business into a success story by clicking the image below.

Sign up today for the best AI features for your business.