Are you tired of hunting for a PayPal review that covers everything about PayPal in a friendly way?

Most people are already familiar with the term PayPal but need to learn how it works. It has been in the market since its launch in 1998 and has become one of the most used online payment methods.

According to statistics, PayPal is one of the leading payment processing methods in the world today.

In February 2024, PayPal had a market share of 45%, followed by Stripe, with a market share of 21%. Given these figures and the gap between the two, PayPal will continue dominating the market.

One advantage of using PayPal is that you can integrate your PayPal business account with your website, making it easy for customers to make payments with one click. This makes the checkout seamless, reducing the rate of cart abandonments.

Today, we will help you understand more about PayPal, both the personal and business accounts.

This review will explain PayPal’s functions, including creating personal and business accounts, sending, receiving, and withdrawing funds, as well as its benefits and cons.

Table of Contents

What is PayPal?

PayPal is a secure online payment method that allows payments conveniently between two different through the website phone app. Users of this Platform can create their accounts and connect them directly to their bank accounts or credit/debit cards.

To start using PayPal services, register and confirm your account. Once done, you can use your PayPal account to send and receive payments. The Platform can be accessed through the official PayPal website, the mobile app, and in person.

PayPal supports more than 100 currencies, and you can withdraw in over 50 currencies. Your balance holds more than 25 currencies. If you have been looking for a convenient and secure online payment method, you can register and try PayPal for free.

How Does PayPal Work

PayPal acts as an intermediary between an individual and a bank. A user adds credit/debit card details or a bank account to the PayPal system when making online payments. PayPal provides payment services to both merchants and consumers.

Merchants mainly enable PayPal payments on their websites or use a PayPal card reader in their physical stores. PayPal offers a wide range of services with competitive rates and no long-term contracts. It has features for Invoices, loans, shipping, and working capital.

For consumers, PayPal provides easy, secure, and convenient money transfers with other individuals like relatives or friends. To transfer cash, one can use the email or phone number of the receipt, whether the receipt has a PayPal account or not. You send money to someone without a PayPal account, and after they receive the payments, they will be prompted to create one.

Creating a PayPal account is free. However, you will incur some charges for using the services. To create a PayPal account, you need an email address to sign up.

Furthermore, provide your bank account, credit card, and debit card to finalize the setup process. An active phone number is also needed, as they use it to verify information and ensure the account owner is setting it up to start receiving PayPal services.

PayPal can be used via mobile apps, websites, integrations, or programmatic interfaces. It has every tool needed to support ecommerce, subscription-based transactions, and point of sale.

The secure Platform PR provides users with purchase resolution, digital security, and seller protection, making it a safe platform for all financial transactions.

But who can use PayPal?

PayPal is a payment platform for everyone. It has many uses and merchant accounts all over the world. Since its launch, PayPal has gained experience and online popularity as the best digital payment method for many e-commerce businesses. The sign-up process is easy for anyone to start using PayPal services.

Creating PayPal Personal Account Guide

To get started with PayPal, you need to create an account first. But don’t panic because the process is easy; anyone can make it, even without guidance. All you need is the correct information, and genuine personal details are authentic. Here is a simple guide to creating a PayPal account on our review.

Create a Free Account

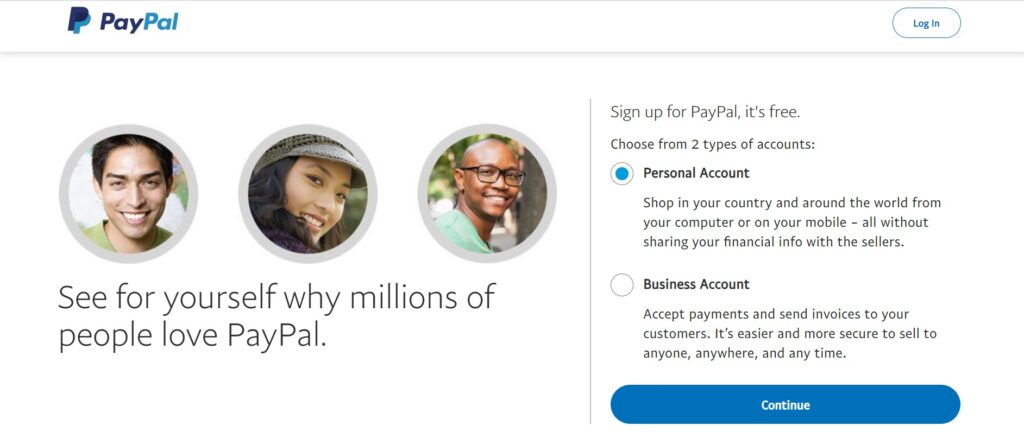

Head to the search bar on your browser and type “PayPal.com.” Click on the first result to be directed to the PayPal home page. Then, click the “Sign Up” button on the upper right. You can create a personal or business account on PayPal. Select the one that you want to make.

A personal account is suitable for exchanging money or online shopping. In contrast, a business account is best for merchants or people who want to use the account for professional services.

You can also download PayPal to your mobile device, which you can use anywhere to make transactions. The PayPal app can be found on the Play Store or the Apple Store.

Fill in the Necessary Details

Before creating a PayPal, you must have all the necessary details, especially your details.

Ensure you have the following information;

- Name

- Date of birth

- Passport number or national ID

- Phone number

- Email address

- Bank routing number

- Bank account number

- Credit/debit card details

With your details ready, you need to start setting up your account. You must fill in the email address you will use for your PayPal account and create a strong password.

Since your PayPal account will contain sensitive information, you must create a secure password that cannot be hacked. Use lower-case and upper-case letters, numbers, and symbols.

Next, you will be asked to provide basic information for your account. Fill in your name, DOB, address, and active phone number. You can open a personal account first, then upgrade it to a business account if you need one.

After filling in all the personal information, check the box to accept PayPal’s “Terms and Conditions.” Before accepting, reading and understanding all the terms and conditions is advisable.

Link to your Bank Account

Linking your bank account with PayPal is essential as it helps you withdraw or add funds to your PayPal account. To link your PayPal account to your bank account, go to the top of the page, click the “Wallet” button, and then click Link a card or bank.

You can link your PayPal account with your bank, debit, or credit card. To do so, enter your account number and the routing number or the number of your credit or debit card. You can get a US virtual account as a non-resident using Wise.

In this step, you will find the following details;

- Bank name

- Branch Code

- Bank code

- Branch location

- Bank account number

- Routing number

To keep offering secure services to its users, PayPal will need you to verify if the linked card or account is yours. Head over to the PayPal Wallet and click the Confirm Credit Card link. PayPal will deduct a small fee from your account to confirm your card or account. Once they confirm the account, the amount will be refunded to your account.

Verify your Account

To complete the registration process, verify the email address you used to create your PayPal account. Go to your email inbox, check the email from PayPal, and click “Confirm Email Address” to verify your account. And that’s all—your PayPal account is now ready to use.

If you connected your phone number during registration, you should verify with a one-time passcode sent via text. Enter the code in the prompted box on PayPal.

Understanding PayPal Pages on Personal Accounts

Before you start using PayPal, it is essential to understand the most critical sections of your account. This will help you master the Platform quickly without wasting time. The main PayPal pages include Home, Activity, Send & Request, Wallet, and Help.

Home

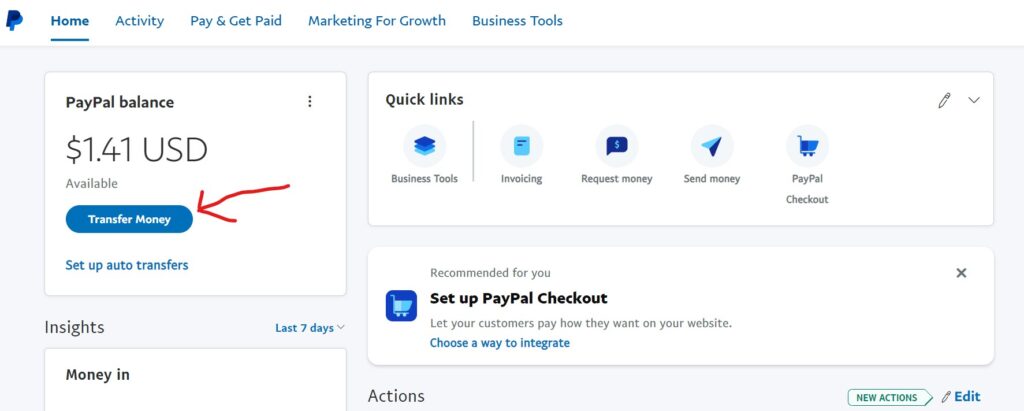

When you go into the PayPal website, the home page is the Summary Page. This page shows you everything that is happening on your PayPal account. You will see the available balance on the top; if the account is new, the balance will be zero.

Under the PayPal balance is an icon titled “Transfer Money.” PayPal is just a digital account; thus, you need to transfer the money into your bank account. Just click the transfer button.

However, if you want to add money to your PayPal account, there are three dots on the right side. You will see three choices: add money, manage currencies, and get help.

Select “Add Money,” and you will be prompted to another page where you choose the bank you want to add money from and the amount you want to add, then click “Add.”

Note that adding money is free, and the bank transfer may take 3-5 days, depending on your bank.

Under the PayPal balance, you will have Recent Activity. It will show you all the types of payments you have received or sent.

Activity

Under the Activity section, you will see all your activities and transactions within a certain period. You can filter the days and types you want, such as payments, refunds, transfers, automatic payments, payments received, and reported transactions.

Also, under the “Status,” you can filter the tracking numbers to add, incoming payments to review, invoices to pay, payment requests to review, shipping labels to review, and holds.

Send & Request

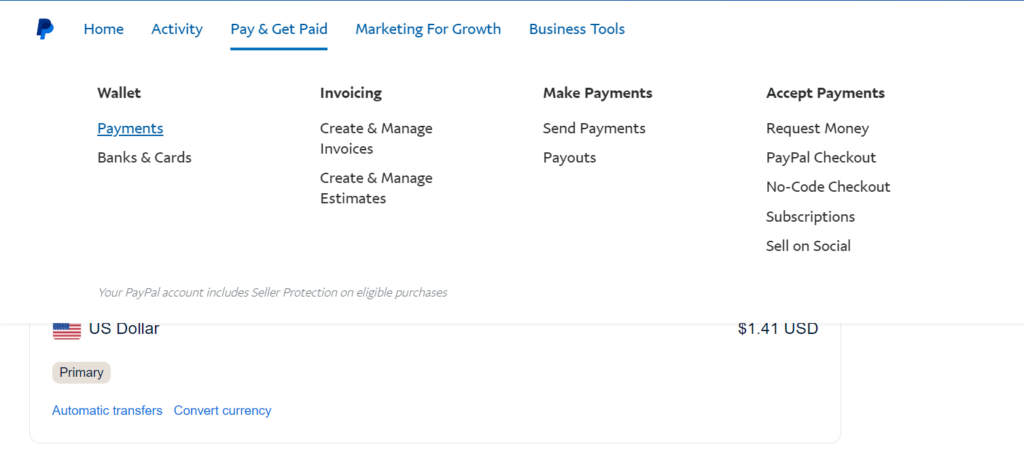

The next page on the PayPal website is the Send & Request page. The page is used to send and request money on PayPal. Some are simple. If you want to send money to someone using PayPal, you only need to enter their email or phone number. Next, enter the amount you want to send.

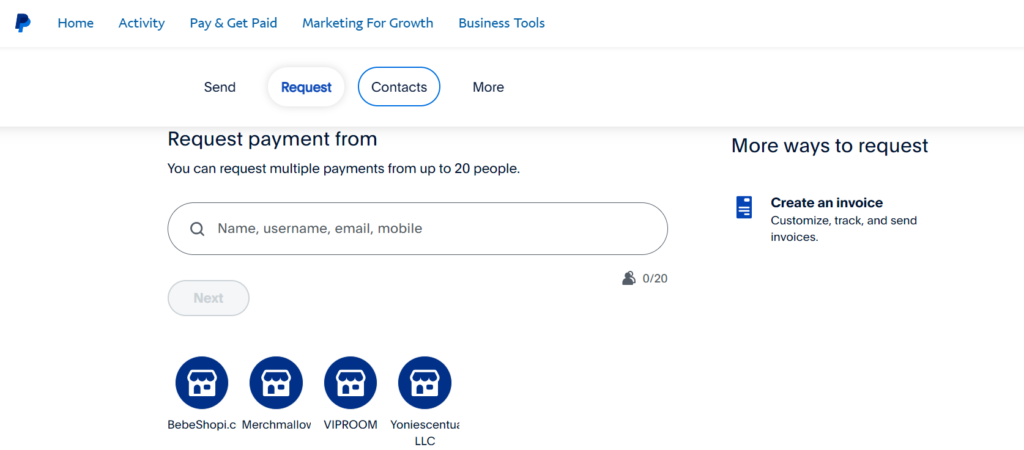

You can also request payments from other people, and the good thing is you can ask from up to 20 people at once. Enter their email or phone numbers, then click next and enter the amount of money you want to ask.

Wallet

The wallet section shows your PayPal account’s available balance.

You will see all the available balances and the currencies you currently use. You can add more currencies or convert your balance into any currency from this section.

To convert the amount, it’s simple:

- Choose the balance currency you want to convert.

- Select which currency you want to convert into.

- Enter the amount you want to convert.

- The amount will be automatically converted.

Before you convert your money to a different currency, you should know how much it will be using the current rate. PayPal has a currency calculator that helps you calculate the current rates and the PayPal currency conversion fee.

Help

Customer support is essential, especially when dealing with online platforms. The help section is set to help users get assistance anytime. It has a set of FAQs (Frequently Asked Questions) that you can use for similar and easy questions.

The help section is divided into different categories, and you can get questions related to the category under each category. Some of the categories include;

- Payments and transfers

- My account

- Disputes and limitations

- My wallet

- Login and security

- Seller tools

Furthermore, there are more sections where you can get assistance with your PayPal account. These include technical help, resolution center, tax center, community forum, and message center. If your questions or issues are more complicated, contact the support team directly under “Contact Us.”

How to Make Payments with PayPal

Paying with PayPal is pretty simple, especially if the receipt has an active account. Go to your PayPal account, then click “Send.” Then, fill in the seller’s email address, enter the amount you want to send and click “Send” to finalize the payment process.

Every transaction you make on PayPal is tracked on the activity page. Furthermore, the activities are protected against fraud through advanced encryption for 24/7 monitoring. Once they confirm the secure payments, they are released to the receipt.

How to Receive Money with PayPal

Receiving money with PayPal is easy. You can use the “Request” button or share your PayPal email address with the money recipient.

To request the money, click the “Request” button, enter the sender’s email, click next, and enter the amount and currency you want to receive. You can also add a note explaining why you requested the money, but this is optional. Then click “Request now,” And boom, you are done.

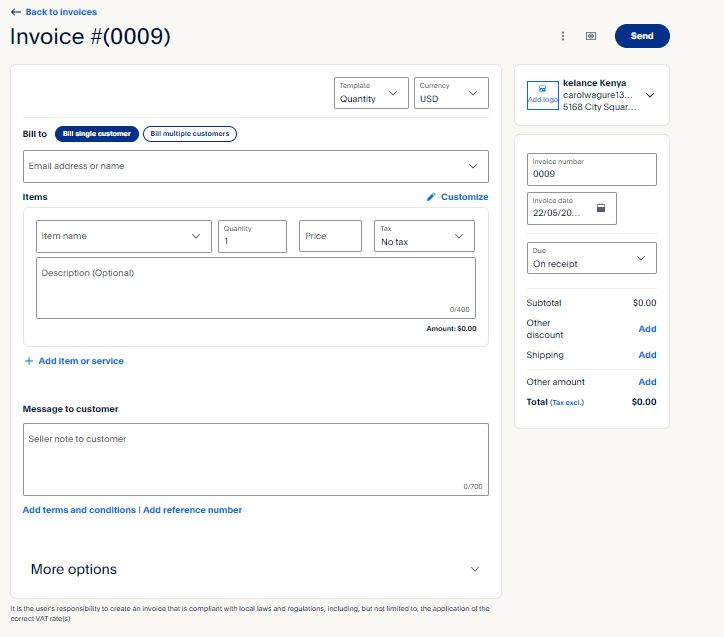

PayPal also allows you to request money using PayPal Invoicing. The service is free of charge, and users can create invoices and send them through a shared link or email. You can request a tip or partial payment for your services as a user. You can also track past invoices, send reminders, and track payments from the PayPal dashboard.

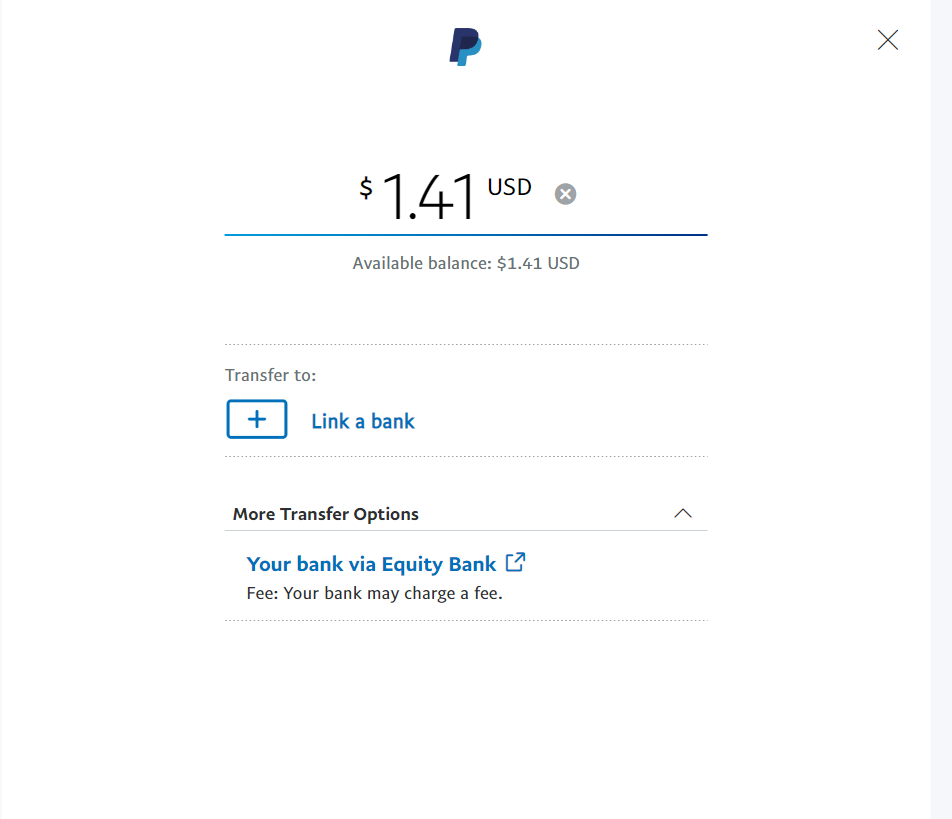

How to Withdraw Money from PayPal to Your Bank Account

You have money in your PayPal account that you want to use, but you need to know how to proceed. Don’t worry about this PayPal review; you will get the necessary answers. Here is a simple guide on withdrawing funds from your PayPal account and transferring them to your bank account.

Head to your Summary/Home page and click the “Transfer Money” icon under your PayPal balance. You can also go to your “Wallet” and find this option.

Next, click “Transfer to your Bank.”

You might have multiple accounts or cards linked to your PayPal account. Select the one you want to withdraw the money to.

Click “Next,” then enter the amount you want to withdraw. Ensure the amount you fill in is available on your PayPal account.

Review the amount you want to transfer, click “Transfer Now, “and complete the transaction.

The amount will be deposited into your bank account shortly. However, the time will depend on the bank you use.

Creating a PayPal Business Account

The boom in the digital sector has been witnessed in different industries, such as the financial one. Before, people used to shop physically and make payments in cash. But today, most people are embracing online shopping as the norm. Thus, demand for online payment options has increased.

PayPal is mainly used to make personal payments. Still, e-commerce business owners are adapting to PayPal to make it convenient, fast, safe, and secure for their customers to make payments.

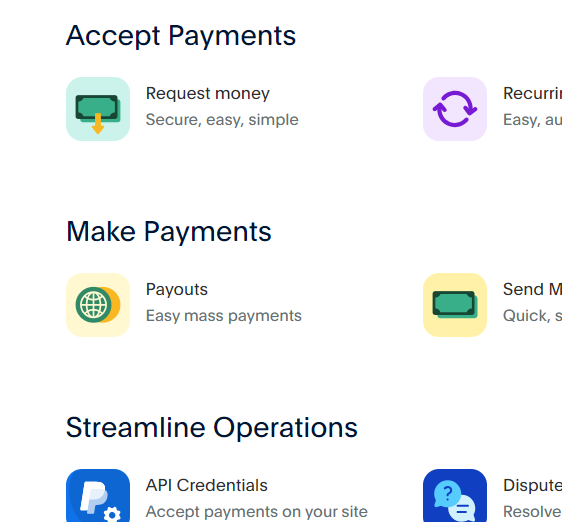

The account has features that allow businesses to accept payments seamlessly. Additionally, you can integrate the business account with your ecommerce platforms.

Types of PayPal Business Account and Merchant Services

PayPal business accounts have different types of accounts that merchants and business owners can choose to receive payments with. The most common types of PayPal business accounts include Payments Standard and Payments Pro.

However, besides the payment processing accounts, the business account offers merchants other services, including PayPal Checkout, payment marketing solutions, and payment business loans and working capital.

Before we help you create a PayPal business account, it is essential to understand these payment processing options and the merchant services.

PayPal Payments Standard

PayPal Payment Standard is a free business account with zero monthly maintenance fee. With this account, you can accept all PayPal payment options except fax, phone, and virtual terminal. You will also enjoy benefits, such as simplified payment card industry compliance (PCI) functionality and free phone support.

If your business is starting or you don’t need checkout options, this is the perfect payment processing method. Once customers make a purchase, they will be taken to PayPal to finalize their payments and returned to the previous site to continue shopping.

PayPal Payments Pro

A PayPal Payments Pro is an advanced account of PayPal payments standard. The plan has all the features of the standard one and the addition of accepting payments through a virtual terminal, fax, or phone.

As a business owner, the Payments Pro gives you control over your checkout pages, making it convenient for customers to make payments with one click. It also helps merchants increase their overall business growth due to exceptional customer support.

However, the Payment Pro comes with a cost. You will need to pay $30 a month for account maintenance.

PayPal Checkout

Most customers find it inconvenient to leave the site and go to a different site to make purchasing payments, so they abandon their carts.

Thus, ld offers a seam checkout procedure so customers can pay without leaving the site.

PayPal checkout is a feature that lets ecommerce business owners add an intelligent payment button to their website or ecommerce stores to allow customers to purchase and make payments with just one click. It lets them avoid complicated orders, including filling out complex payments.

To add this feature to your ecommerce site, you will need to integrate it into your business site. Since the process might be complicated, you can hire a developer to help you with the implementation.

PayPal Marketing Solutions

Payment methods have different features and unique invoicing options for standard and pro payment accounts. Another fantastic feature includes PayPal Marketing Solutions, which shows how much owners spend, how customers interact with the checkout, and how customers often shop.

To start using this feature on your website, copy and paste a given code snippet and paste it to your website.

PayPal Business Loan and Working Capital

Running a business can be challenging, especially if you need more cash flow. PayPal makes it simple to get funds if you need to expand your business. The PayPal business account funds businesses with this fantastic feature, PayPal Business Loan and Working Capital.

The application process for either of the two options is easy, and once requested, it can be approved within one business day. The entry barrier is low compared to other lenders.

Business loans and working capital are different. The significant difference between these two options is that business loans range between $5,000 and $500,000, while working capital ranges between $1,000 and $300,000.

To qualify for a Business Loan, you must meet specific criteria, such as having a business over nine months old, earning at least $42,000 in revenue, and passing a credit check.

The account owner can set the repayment terms, which range between 13 and 52 weeks.

Qualifying for PayPal Working Capital is easy, as there is no minimum revenue or credit check. However, you need to be an existing PayPal user with an active account for at least three months and have transacted more than $15,000 using PayPal for the past year. You can get a working capital of 35% on your PayPal sales. PayPal deducts a certain percentage that you choose from your PayPal sales.

Read Also:

- Zendesk Alternative: Why Choose Ecommercebot

- Engati Alternative: Why Ecommercebot Tops The List

- How Do I Find A Supplier For My Dropshipping?

- 10 Best WordPress Chatbot Plugins For Your Website

- How To Create Instagram Posts With AI

How to Open a PayPal Business Account

Before opening a PayPal business account, you need to have the following documents and details;

- Name of the owner

- Address of the account owner

- Email address

- Legal business name

- SSN (Social Security Number)

- Employer identification number

- Bank name

- Bank account number

- Bank routing number

Once you have gathered the above documents and details, it’s time to open your PayPal business account. Setting up your business account takes only a few minutes. You can start with a free account and then upgrade later.

Sign Up your Account

The first step is to go to PayPal.com and click sign up. You will see two different options: personal and business. Choose the business account since you are creating a PayPal business account instead of a personal one.

Now, enter your business email address and other essential business details.

Create a strong password that is hard to crack because you handle your account finances. Ensure the details match those on the business license to avoid security issues.

Explain More about Your Business

It would help if you told me more about your business now. PayPal needs to understand more information about your business.

This includes filling in your business information, such as service or product keywords, country of registration, company URL, date of registry, and business registration number.

Please provide more information about your business. Please indicate whether your business is a partnership, corporation, sole proprietorship, government, or nonprofit.

You might need more information about the services or products your business deals with based on your response.

Legal Representative Information

PayPal needs to confirm the legal representative information. You must provide your personal information, such as your country of birth and current residency country. You can fill in your ID number or use your passport number.

Once you have provided all your business and legal representative information and confirmed it is correct, click “Submit” to send you the details.

Confirm Email

After signing up for your PayPal business account, you will receive an email from PayPal asking for verification. Go to your email inbox, then click the link sent by PayPal to confirm your email address. If you don’t receive the email, request another link from the PayPal website.

Link your Bank Account

You must link your bank account with your PayPal business account to use or withdraw money from PayPal.

PayPal uses encryption and data protection to ensure the safety of all online transactions. Linking your bank account with your PayPal business account is simple.

Log in to your PayPal account, then go to “Link Bank Account.” Provide all the necessary information. You can use your personal or business account to link your bank account. To finalize the linking, you must provide details such as the bank name, bank account number, and routing number.

PayPal will need to verify the information, so you will receive a verification request to make two small deposits to your account. The process can take 3-5 days, so check your bank account occasionally for verification. Once the transactions are complete, it’s time to set up your account.

Congratulations on setting up your account with the help of our PayPal review. Now, you can choose the payment method your business will accept from customers and explore all the features available on your PayPal business account.

How to Upgrade My Personal PayPal Account to Business Account

When discussing creating a personal PayPal account on our review, we talked about upgrading your account to a business account. Now that you have opened your online store and want to upgrade from your account to a business account so that customers can pay you through PayPal, let’s help you upgrade your account.

You first need to review your account status and ensure your details and email address are up to date when upgrading, which will help you avoid some issues related to the process.

Additionally, gather all necessary information and documents. Ensure you have your business name, tax ID number, and address ready.

Upgrading Personal PayPal Account to Business Account

To upgrade your account to a business account, you need to log in to your account first. Then, head to the PayPal dashboard.

From the dashboard, click the “Settings” icon. Once you click the button, you will see an option for “Upgrade to a business account” at the bottom. Click the link.

The first thing you will be asked about is the business type. You need to choose one among the given options;

- Individual/sole proprietorship

- Sole proprietor

- Partnership

- Corporation

- Public corporation

- Private Corporation

- Nonprofit organization

- Government entity

After selecting your business type, click “Continue.” You will be given two options: creating or upgrading a new business account. Choose “Upgrade your account,” then continue.

Fill in all your business information on the provided form, such as business name, address, and currency, then tick the box to agree to the user agreement and privacy statement, then click “Agree and Upgrade Account.”

After this process, you must link your website with the prompt. You need to provide your EIN (Employer Identification Number). Remember, you can use your Social Security Number if your business is a sole proprietorship.

Advantages of Using PayPal

PayPal is one of the leading online payment platforms in the world today. Its many advantages make it suitable for anyone, especially regarding security. Here are some of the significant benefits of using PayPal.

Security

One thing that PayPal prioritizes most is user security. When paying on sites or with people you don’t trust, entering your financial details, such as card details, can be a threat, as these details can be used to hack into your bank accounts.

Using PayPal is secure; you only need to enter your login information to process the payment. PayPal has tight login security and two-factor authentication, which makes it hard for other people or hackers to access your account.

You can use your card funds or account and be 100% sure that the website or the people you are paying for cannot see your card or account details.

Easy and Convenient Payments

One of the most used payment options is PayPal, which is available to most users online. It makes it easy to buy and pay for products online.

Sometimes, online payments can be challenging, especially if you need a credit card. That’s where PayPal comes in. The Platform lets you quickly, securely, and conveniently make online payments. You can use PayPal to make payments using funds on linked accounts or cards.

To use PayPal, you need to remember your login information, such as the email you used and your password. With PayPal, making online payments is more convenient and faster than before.

PayPal Credit Options

When you start a business, sometimes it can take effort to get funds to keep it running.

However, PayPal offers funding to keep your business running. PayPal offers small business owners credit services such as PayPal Working Capital. However, the loans vary depending on your business account’s previous sales history.

The credit forms have no long waiting periods, lengthy forms, or hidden charges. To make the repayments, a certain percentage is deducted from your account on every sale you make daily. It is also easy because your account has the necessary information.

International Payments

PayPal makes it convenient for people to send and receive payments from anywhere globally. However, international payments can be challenging, as you might want to transfer or receive funds from a different country.

Each country has its available payment methods, which can be unavailable in other countries. Thus, it becomes inconvenient to receive or send money. PayPal offers a convenient way to send and receive funds from most countries worldwide.

Invoicing and Managing Payments

Compiling an invoice can be challenging, as you have to fill in all the data manually, and sometimes mistakes can happen. With PayPal, you don’t have to do all these tasks manually; the Platform has an invoicing system that makes making and managing payments easy.

For business owners, they can create and send invoices, track the status of the invoice, and even set automatic payments for regular clients.

PayPal also sends automatic payment reminders, saving users from wasting time chasing late payments. Since the Platform does most tasks, it can save time and reduce administrative members. You can also track your transactions in real time.

Mobile App Capabilities

In today’s digital era, the rise of mobile devices is increasing daily. And most people prefer to use mobile devices to do most activities online. Thus, it is advisable for many service providers to like payment options accessibility.

PayPal has a mobile app that you can download on Android and iOS devices. Therefore, users can send and receive payments in their accounts anytime.

Another advantage of having mobile capabilities is that business owners have an added advantage. They can track sales, access customer information, and manage payments from their homes. Using the PayPal app for a business account, one can issue refunds, withdraw, and transfer funds through the app.

Disadvantages of Using PayPal

Even with all the above advantages, PayPal has its share of disadvantages. It would help to weigh some disadvantages before choosing PayPal to make online transactions.

Account Limitations and Hold

Most PayPal reviews online show that most people complain about their accounts being held or, at times, freezing with no warning. The account holds last for days or even months, but within the period the account is on hold, you can’t withdraw funds from your account.

It can be challenging to rely on PayPal for cash flow, as when the account is on hold, you must cover your other operations and expenses. However, these restrictions protect users against fraud while using the Platform.

Transaction Fees

Transaction fees are one of the significant drawbacks of using PayPal. The Platform charges high transaction fees for every transaction you make. PayPal charges a total fee of 2.9% and a fee based on the currency you use. Although these fees are low, they can add up quickly and become expensive. They can start affecting and eating your small profit margins as they add up.

High International Fees

The cost of sending payments to international users is high. Anytime you want to transfer funds to a global user with a foreign currency, the conversion fee is around 3%-4%, plus any other extra charges. This makes it expensive to send or receive funds internationally.

Final Thoughts on PayPal Review

You know everything you need to use PayPal as your payment processing method. Creating a personal or business PayPal account is seamless; all you need to do is meet the requirements and provide the correct details. However, contact the support team if you need help opening your account. To offer a seamless customer experience, connect PayPal checkout with your e-commerce website.

Apart from using PayPal Marketing Solutions on your website, you can also integrate your ecommerce store with Ecommercebot to help you market your business and offer exceptional customer support, thus enhancing your customer experience journey.

You can try Ecommercebot for free; no credit card is required. You agree to turn your E-commerce business into a success story by clicking the image below.

To try Ecommercebot, you can use our one-month free trial without a card.

Frequently Asked Questions (FAQs)

Is it risky to use PayPal?

No, it is not risky to use PayPal, as all sensitive information is secure and protected from fraud and scammers online.

Why use PayPal instead of a debit card?

PayPal stores all your bank and card information in one place. You only need to remember your email address and password as a user. Additionally, PayPal keeps your information safe, especially when using sites you can’t trust because you don’t have to share your card information.

Is there a fee to use PayPal?

No, PayPal is free to use when making commercials or purchasing online, but you can incur some charges if the transaction involves currency conversion.

What are the pros and cons of using PayPal?

PayPal has pros that make it suitable for processing payments online. Major pros include security, international payments, PayPal credit options, mobile app capabilities, invoicing, and managing costs. Additionally, this Platform has cons like high international fees, account limitation and hold, and transaction fees.

How long does it take to upgrade my account to a business account?

Upgrading your account to a business account takes only a few minutes. However, the account verification can take longer.